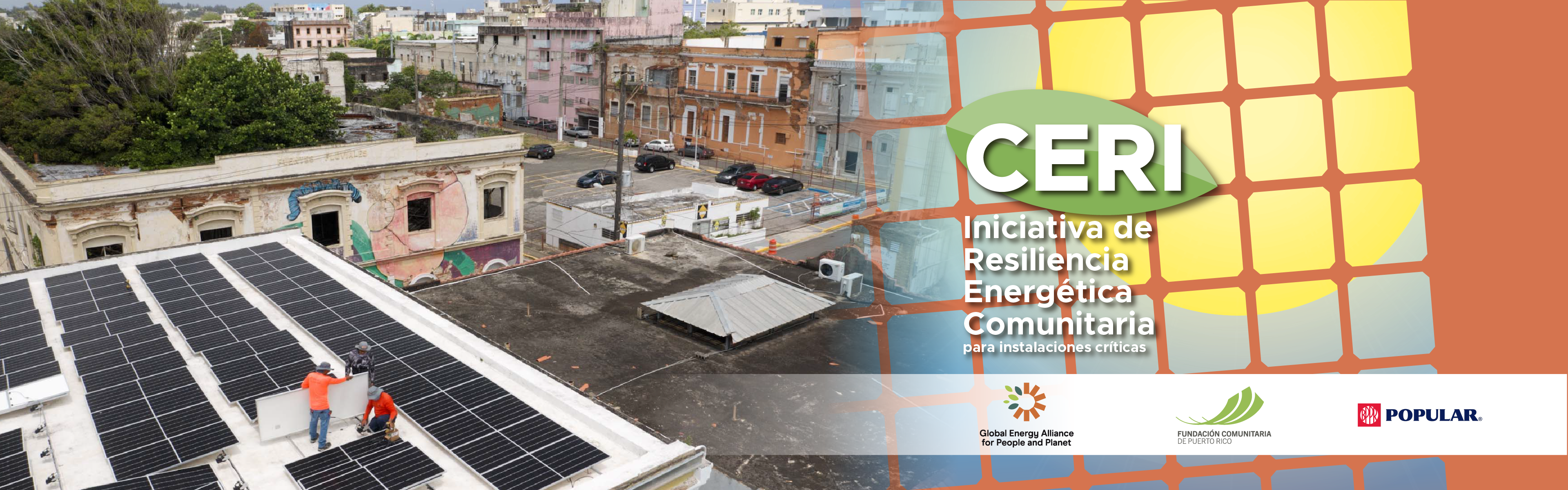

The Community Energy Resilience Initiative (CERI) is driven by Global Energy Alliance for People and the Planet (GEAPP) and managed in Puerto Rico by the Puerto Rico Community Foundation (PRCF).

The program introduces an innovative model for accessing financial capital through subsidy and loan to businesses essential in times of emergency; and through grants, donations and loans to nonprofit organizations that become the meeting and survival point of our communities.

The loan component will be made through Banco Popular de Puerto Rico (BPPR), the grant will be provided through a GEAPP investment, and the donations to the nonprofit organizations come from BPPR and Mellon Foundation.

The purpose of the program is to prevent the interruption of essential services that provide critical facilities in communities in Puerto Rico, due to outages during and after a natural event or due to the instability of the archipelago's electrical system.

The loan and grant are subject to credit approval by BPPR. Certain restrictions apply. The grant is subject to availability of funds.

Eligibility requirements are: be a business or non-profit organization defined as a critical facility under the CERI Program (critical facility defined below); have been in operation for more than five years; have a gross revenue of less than $3,000,000; not have a solar renewable energy system on the structure (property) for which it would be applying to participate in the CERI Program; own the property where the solar energy system would be installed; not need to build a carport or additional structure to the existing one for the installation of the solar system; be in compliance with tax obligations; apply for financing through Banco Popular de Puerto Rico (BPPR); and other requirements established later in the process, including credit approval and BPPR restrictions that may apply.

What is energy resilience?

For a site to be energy resilient it must, in addition to the connection to the central energy system, incorporate other mechanisms to access energy such as solar panels, energy storage, among others. At CERI, we seek financing to enable you to acquire solar energy and storage infrastructure for critical facilities.

Access to financial capital

The procurement of the solar and storage system is made possible by a novel and proven hybrid financing model consisting of grant and loan for businesses; and grant, donation and loan for non-profit organizations.

Parameters for access to financial capital

The parameters of access to financial capital depend on a thorough analysis of the needs and capabilities of the business or organization. In the case of businesses, the grant is up to 20%; in the case of non-profit organizations, the grant is up to 20% and the donation is up to 30%.

The loan and grant are subject to credit approval by BPPR. Certain restrictions apply. The grant is subject to availability of funds.

Energy resilience pathway for your community

Critical facilities to be considered in CERI are those that provide essential social and economic services during and after an emergency event.

CERI defines them as businesses and non-profit organizations considered critical because of the essential services they provide to the community and that in times of emergency provide continuity of services vital to the survival of the community.

Facilities offering services within the following sectors may be considered for CERI - government-owned facilities are outside the scope of this initiative.

The following are examples of critical installations to consider:

Communication services

- Television and radio stations

- Wireless communication facilities (internet and cellular)

Food services

- Supermarkets and grocery stores

- Bakeries

- Restaurants and cafeterias

- Food banks

Infrastructure services

- Community aqueducts

- Community wastewater treatment plants

- Hardware stores and hardware equipment suppliers

- Contractors' offices

Health

- Hospitals and community health clinics

- Care centers for the elderly

- Physical therapy and rehabilitation centers

- Dialysis or cancer treatment centers

- Community pharmacies

- Centers offering ambulance, paramedic and other rescue services

- Dental clinics

- Centers for mental health services

- Controlled substance abuse treatment centers

Social Services

- Homeless shelters

- Shelters for victims of domestic violence

- Day care centers for infants, toddlers and children

- Shelters for people displaced from their homes due to natural phenomena

- Community centers

- Child and adolescent day care centers (foster care)

- Adoption centers

- Community call centers for emergency situations

- Medicine cooling center

Transportation

- Public trolley stations

- Charging centers for electric cars

- Gas stations and refueling

Others

A business or nonprofit organization that provides essential life-saving, emergency or economic services; supports vulnerable or dependent populations; and/or ensures continuity of health and safety during a disaster, while assisting in recovery efforts and the continuity of government, business and other services after a disaster.

Documents required for preliminary evaluation

In order for your business or organization to be considered, you must submit the documents listed below.

Business

- Financial statements or payroll for the last two years.

- Statement of Financial Position (Balance Sheet) if filed as an individual (with evidence of filing).

- Interim financial statements if more than six months have passed since the close of the fiscal or calendar year.

- Financial statements or individual guarantors' pay slips (not older than 12 months from year-end), as applicable.

- Bank statements for the last three months if you maintain an operating account with a bank other than Banco Popular de Puerto Rico.

- Financial statements or schedules of affiliated institutions for the past two years and Interim Financial Statement, if more than six months have passed since the end of the fiscal year.

- Evidence from the Department of State: certificate and articles of incorporation.

- If a corporation, the corporate bylaws (Bylaws-Bylaws).

- If it is a limited liability company (LLC) it must include the Operating Agreement or a resolution indicating the corporate business structure.

- Use permit (if the business has been operating on the premises for less than three years).

- Valid and up to date municipal license.

- Merchant Registration Certificate - valid and up to date IVU certificate.

- If you are a withholding agent you must provide a Certification of Indebtedness Model SC 6096 (current as of the date of loan closing).

- Title deed or deed of the site where the system will be installed.

- Electricity bill, preferably for the last 12 months.

Non-profit organizations

- Financial statements or payroll for the last two years.

- Interim financial statements if more than six months have passed since the close of the fiscal or calendar year.

- Bank statements for the last three months if you maintain an operating account with a bank other than Banco Popular de Puerto Rico.

- Department of State evidence of Certificate of Incorporation or Articles of Incorporation.

- Certificate of Good Standing from the Department of State.

- Financial statements or schedules of affiliated institutions for the past two years and Interim Financial Statement, if more than six months have passed since the end of the fiscal year.

- Corporate Bylaws (Bylaws-Bylaws).

- Use permit (if the business has been operating on the premises for less than three years).

- Merchant Registration Certificate.

- If you are a withholding agent you must provide a Certification of Indebtedness Model SC 6096 (current as of the day of the loan closing).

- Tax exemption certificate 1101.01 from the Treasury Department or 501c3 from the federal government.

- List of the Board of Directors.

- Conflict of Interest Policy signed by the members of the Board of Directors.

- Copy of the property deed.

- Electricity bill, preferably for the last 12 months.

The FCPR reserves the right to request other documents if necessary for the evaluation, recommendation and approval of grants or donations. The BPPR reserves the right to request other documents for the evaluation and approval of the loan.

Some documents will be requested at an early stage to determine programmatic eligibility prior to applying for funding.

Stages of CERI

1 SEEDING STAGE

REFERRAL MANAGEMENT AND ELIGIBILITY DETERMINATION

Orient the community-based nonprofit organization or business to the requirements for eligibility, selection and participation in the CERI Program. Key action at this stage includes orienting and providing information to determine initial eligibility.

2 GERMINATION STAGE

ANALYSIS AND SELECTION OF POTENTIAL CUSTOMERS

Analyze the estimated capacity of the solar system based on the consumption of the Capacity Customer, estimate necessary investment, identify availability of required documents, select the Capacity Customer and validate their interest in continuing. Actions include:

● Preliminary techno-economic analysis: technical and financial evaluation of the project, energy consumption analysis, estimated annual energy production, estimated potential savings, estimated equipment cost, net present value, cash flow and financial need to determine technical and economic feasibility of the project.

● Availability of documents: verification of the documentation required to move forward in the program process.

● Validation of Power Client Interest: obtaining the Power Client's approval to continue in the Program by signing a participation agreement.

Note: The FCPR reserves the right in its sole discretion to continue the Power Client to the next Flowering Stage (Stage III) if it determines that the conditions, characteristics or technical or financial capacity do not exist to ensure future compliance with the obligations of the CERI Program, or if it determines that other criteria are not met in accordance with the CERI Program.

3 FLOWERING STAGE

DETERMINATION OF FINANCIAL SUPPORT

Support for the Potential Client to have the technical information and recommended subsidy/donation amount prior to the loan application. Loan application documentation is submitted by the Potential Client to the selected financial institution and branch office.

Actions at this stage include:

● Selection of contractor, quotation of the cost of the solar energy system and signing of installation contract with selected contractor.

● Validation of documents required prior to funding application.

● Determination of the amount to be funded (including determination of the amount of grant, and donation when they are non-profit organizations).

● Submission of the loan application to the selected financial institution and branch of the program by the Power Client.

● Decision of the financial institution on the loan application.

4 HARVEST STAGE

IMPLEMENTATION AND MONITORING

In the last stage, once the financing is approved, the solar system is installed at the CERI Client. The actions include:

● Installation of renewable energy system.

● Programmatic evaluation of the solar energy system, satisfaction assessment and other programmatic details to maintain a recurring flow of information from the CERI Client to the FCPR.

Fundación Comunitaria, facilitator of the process...

The FCPR, or its representatives, act as a facilitator in the CERI Program implementation process. One of its roles as a facilitator is to provide ongoing support and advice to help facilities comply with grant/grant requirements. This accompaniment is key to ensuring potential clients navigate the process effectively.

The Power Customer, by submitting its application, acknowledges and accepts that FCPR, or its representatives, will carry out a techno-economic analysis, prior to signing a participation agreement. In order to carry out the analysis, the Power Customer must submit information on its consumption (electricity bills for the last 6 months) and updated information on its financial situation.

The Power Client (community-based nonprofit organization or business) acknowledges and agrees that the contractual relationship for the loan component under the CERI Program would be with BPPR, if such loan is applied for, approved, contracted and taken out by the Power Client, and that the contractual relationship for the installation of the solar system would be with the contractor installing the solar system. Upon completion of the programmatic evaluation of the completed system and project, the FCPR will terminate its obligations to the Power Client (community-based nonprofit organization or business). Thereafter, any subsequent contractual relationship will be solely between the contractor and the business or community organization.

Applying for the CERI Program and/or accepting the conditions set forth herein is not a promise of payment, grant or donation, nor is it a guarantee of participation in the CERI Program. FCPR reserves the right to determine who participates in the CERI Program.

In the event that the grant or donation necessary to make the financing of the solar energy system feasible is greater than what the Puerto Rico Community Foundation (PRCF) can provide to the CEP, the PRCF shall have no obligation to contribute, seek or identify additional resources, reserving in such case the right to not approve the grant or donation, as well as not to submit the application for the loan component under the CERI Program to the BPPR. The FCPR reserves the discretion to recommend and subsidize only those cases in which, in its sole discretion, it believes that the amount recommended allows for the feasibility of the installation of the solar energy system, in accordance with the objectives and purposes of the CERI Program.

CEP agrees that its participation in the CERI Program also does not at any time guarantee the granting of the loan component under the CERI Program, which will at all times be conditioned upon application and approval of credit by BPPR in its sole and exclusive discretion, according to its credit policies. The FCPR at no time makes any credit evaluation nor will it take part in the decision on the loan component.

The FCPR has no control, interference, or ability to make recommendations on loan component applications. Nothing obligates CEP to apply for or take the loan component. The decision to apply for the loan component and to take the loan component, if approved, is at CEP's sole and exclusive discretion, but participation in the grant component under the CERI Program may be conditioned on participation in the loan component.

Allies of energy resilience

CERI is made possible through a strategic alliance between the FCPR, GEAPP and BPPR.

The partnership seeks to provide critical facilities located in vulnerable communities in the archipelago with clean, affordable and reliable energy through access to financial capital to boost energy resilience, thereby saving lives and protecting the environment.

Origin of CERI

The Community Energy Resilience Initiative (CERI) emerged as a pilot project in 2020 when the Global Energy Alliance for People and Planet (GEAPP), Rocky Mountain Institute (RMI) and Fundación Comunitaria de Puerto Rico (FCPR) joined forces to promote energy resilient community facilities. These would be facilities that provide essential services to a community that is often located in places with little access to basic resources and that are the first to be activated to accompany and provide the community with a space to receive immediate help, supplies and/or a meeting point. Starting in 2022, CERI's pilot projects began: Instituto Pre-Vocacional e Industrial de Puerto Rico (IPVI), in Arecibo, Farmacia Jomari, in Patillas, and Valentín Service Station, in Utuado; followed by Casa Ramón, of the Red por los Derechos de la Niñez y la Juventud de Puerto Rico, in Juncos, and Panadería Mi Arcoiris, in Jayuya.

FCPR

We build the capacity of communities to achieve social and economic transformation by increasing community capital; and we encourage philanthropic investment and maximize the impact and return on each contribution. One of our current programmatic focuses is access to renewable energy.

BPPR

(NASDAQ: BPOP) is the leading bank in terms of deposits and assets in Puerto Rico and is among the top 50 bank holding companies by assets. Founded in 1893, Banco Popular de Puerto Rico, Popular's principal subsidiary, provides individual banking, mortgage and commercial banking services in Puerto Rico and the U.S. Virgin Islands. Popular also offers auto and equipment financing, investment and insurance services in Puerto Rico through specialized subsidiaries. In the United States, Popular provides individual banking, mortgage and commercial banking services through its New York banking subsidiary, Popular Bank, which has branches located in New York, New Jersey and Florida.

GET IN TOUCH! To learn more about CERI and/or get involved, write to accesoaenergia@fcpr.org.